- Details

- Written by Gordon Prentice

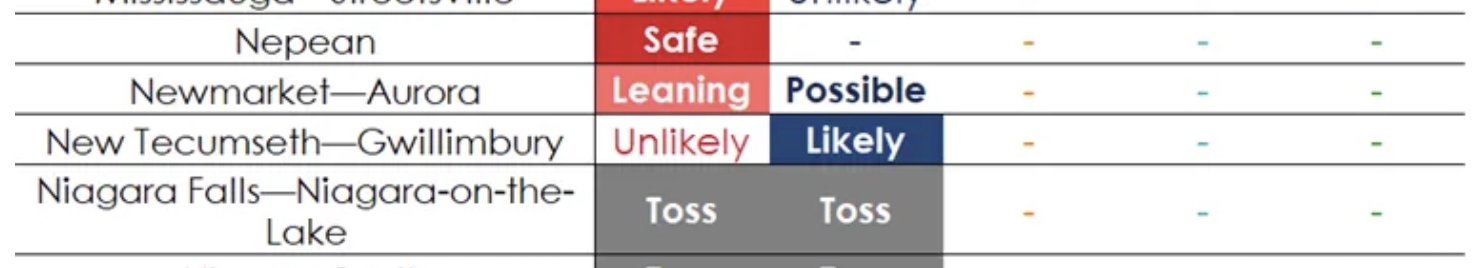

The latest projection from Éric Grenier - who does the CBC's Poll Tracker - puts the Liberals as the likely winners of the election in Newmarket-Aurora.

This is the state of play on Saturday 5 April 2025.

Grenier defines likely and unlikely this way:

Likely means the party has a high likelihood of winning the seat, though there is an outside chance (less than 5%) that another party could win.

The converse, unlikely, means the party is not in serious contention for the seat, but there is an outside chance that, with enough polling and modelling error and/or local dynamics at play, the party could pull off an upset. This is the flipside of the “Likely” rating.

The big unknown is whether the NDP candidate, Anna Gollen, will secure the 100 endorsements from local electors which she needs to get on the ballot paper. We shall know on Monday.

If it is a straight fight between the Liberals and the Conservatives there is little doubt Jennifer McLachlan will be our next MP.

That said, it ain't over 'til the fat lady sings.

This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Gordon Prentice

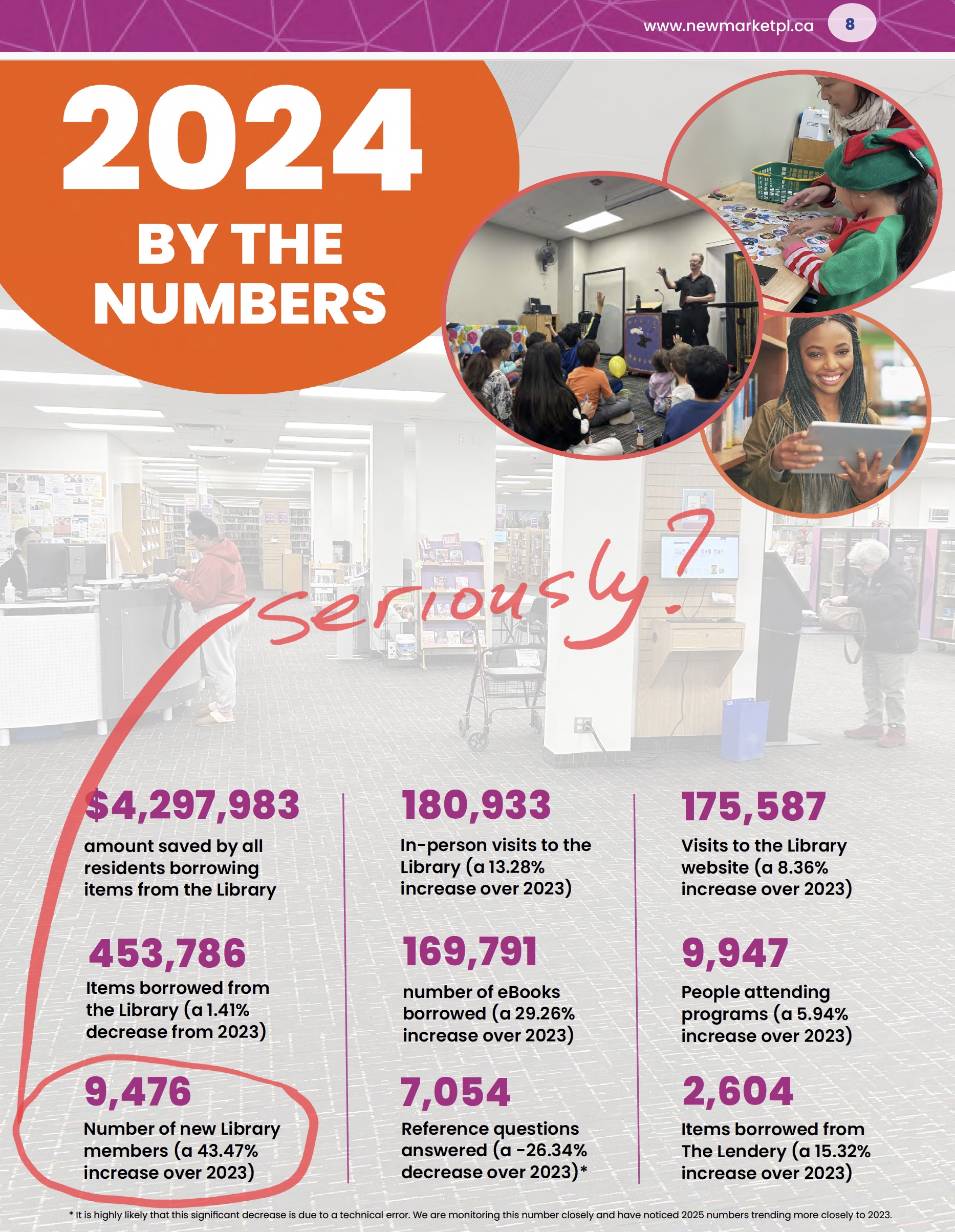

Newmarket Public Library’s membership rocketed last year by an eye-watering 9,476 new members. We are told this was a 43.47% increase on 2023.

These figures remind me of the old tractor production statistics we used to get from the former Soviet Union.

So good they can’t possibly be true.

The Library’s Chief Executive, Tracy Munusami, will be giving a presentation to Newmarket councillors on Monday (7 April 2025) on the Library’s annual Report to the Community 2024 and I shall be interested to hear what she has to say.

Amazing!

In the time she has been in charge I have grown used to Ms Munusami’s well-polished library lingo.

Everything is amazing, exciting and extraordinary.

So when Library Board chair, Darryl Gray, told us in the foreword to the Library’s latest Report to the Community that 2024 had been extraordinary and membership had grown significantly I had to take a second look.

“This past year has been extraordinary for the Newmarket Library, marked by significant growth in membership and an expanded presence throughout our community.”

Where did the 9,476 new members come from?

It wasn’t from the Library’s outreach programme which saw “new card memberships” increase by 595 in 2023 and 1,543 in 2024.

A simple request. Can we have the number of library members for 2024 and for 2023?

Comparisons

It’s not an easy job tracking down the figures. We used to get detailed statistics on library usage in a time series that allowed us to compare performance over the years. But that’s all been thrown out of the window.

In the latest Report to the Community we see, for the most part, amazing percentage increases in Library usage from 2023. And where, unusually, we see a 26.34% decrease in “reference questions answered” we are told:

“it is highly likely that this significant decrease is due to a technical error”.

Significant increase

It may well be that these “new members” are simply former members rejoining the library after the COVID pandemic. Perhaps the library suspended membership renewals during COVID. But if that is the case then the “significant” increase in membership should be labelled as such.

I wrote to Ms Munusami last December about the Library’s outreach work and about the huge increase in the number of “out-of-town” members.

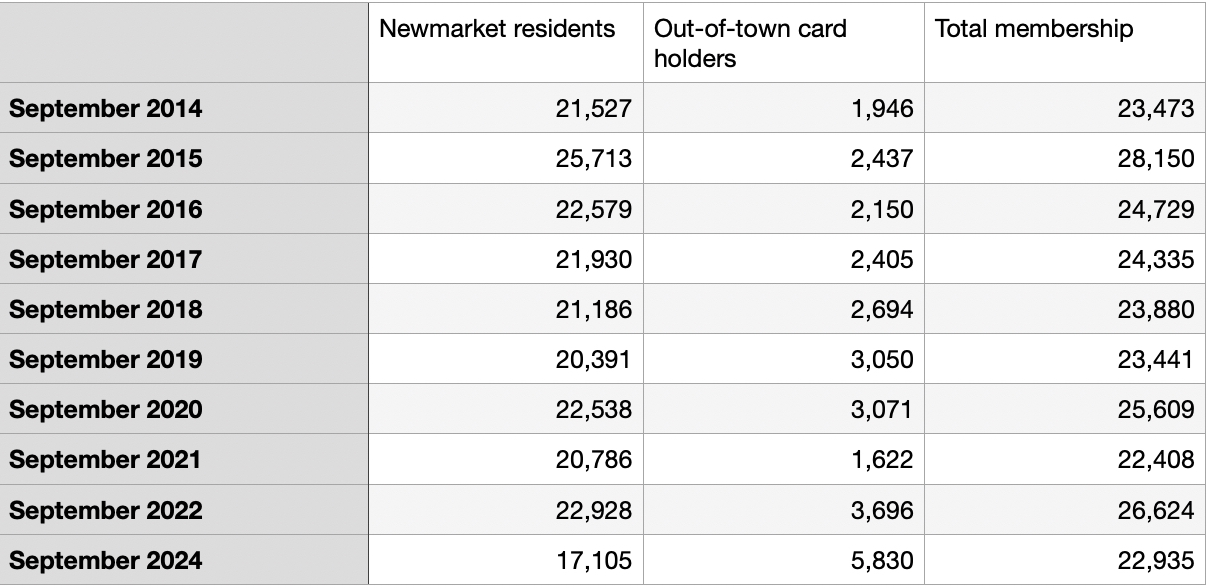

In September 2024 the number of out-of-town members (5,830) was more than a quarter of the total membership which, at that point, was 22,935.

I asked her:

“What explains the very significant increase in out-of-town members in 2024? In speaking to your counterparts in neighbouring libraries, is this surge in out-of-town members something that they too are experiencing?”

She told me:

“Over 3.9 million Ontarians, or nearly 27% of the population, hold a public library card. Collectively, the goal across Ontario public libraries is to provide equity of access to information and contribute to education, literacy and life-long learning. This starts with getting more people through library doors, which is why we open ours.

The Newmarket Library has a long-standing reciprocal borrowing agreement with York Region Libraries, Bradford West Gwillimbury Library and Brock Township Libraries.

We have removed barriers to open up our membership system so our library is accessible to anyone who may come through its doors. This included removing fines and welcoming our out-of-town neighbours to become members.

We also know that Newmarket is a regional hub that brings people into our community for shopping, recreation and culture programs, and healthcare, which in turn may bring more people into our library.

In speaking with library counterparts, we all take a similar open-door approach, so much so that many libraries do not distinguish out-of-town users within the data they capture.

The Library receives funding from the province in addition to municipal funding.”

Her reply didn’t really answer my question.

Free membership, Province wide

Newmarket library now allows free membership to anyone living in Ontario. That means non-residents can borrow what they like and sign up to services such as Hoopla which costs the Library money for each item borrowed.

This is a different approach from many other libraries in Ontario. They charge non-residents fees unless reciprocal arrangements apply. For example, Bradford and West Gwillimbury charge $60 a year; East Gwillimbury $40; Toronto $150; Hamilton $100; Burlington $63 and so on.

Our neighbour, Aurora, charges an annual fee of $80 to non-residents coming from areas with no reciprocal agreement.

The Library Chief Executive, Jodi Marr, tells me the number of these non-residents is 10 or less.

Breakdown

So are these out-of-towners joining Newmarket Library for free and then using their membership to access other libraries in York Region where a membership fee would ordinarily have to be paid?

Should Newmarket Public Library collect and publish a breakdown showing the numbers of resident and non-resident members and those with reciprocal memberships?

Tracy Munusami would probably say it serves no useful purpose.

I disagree.

The library has just started to collect and make available Library membership numbers by ward. That's progress.

So why abandon collecting statistics on non-residents?

Is it just too much hassle?

Or not exciting enough?

This email address is being protected from spambots. You need JavaScript enabled to view it.

Note: I was told last year that the full range of library statistics for 2023 was not collected.

Click "Read More" below for email from NPL's Chief Executive

Update on 9 April 2025: From Newmarket Today: Focus on Community Outreach gives Newmarket Library a growth spurt

Read more: Newmarket Public Library Report to the Community 2024

- Details

- Written by Gordon Prentice

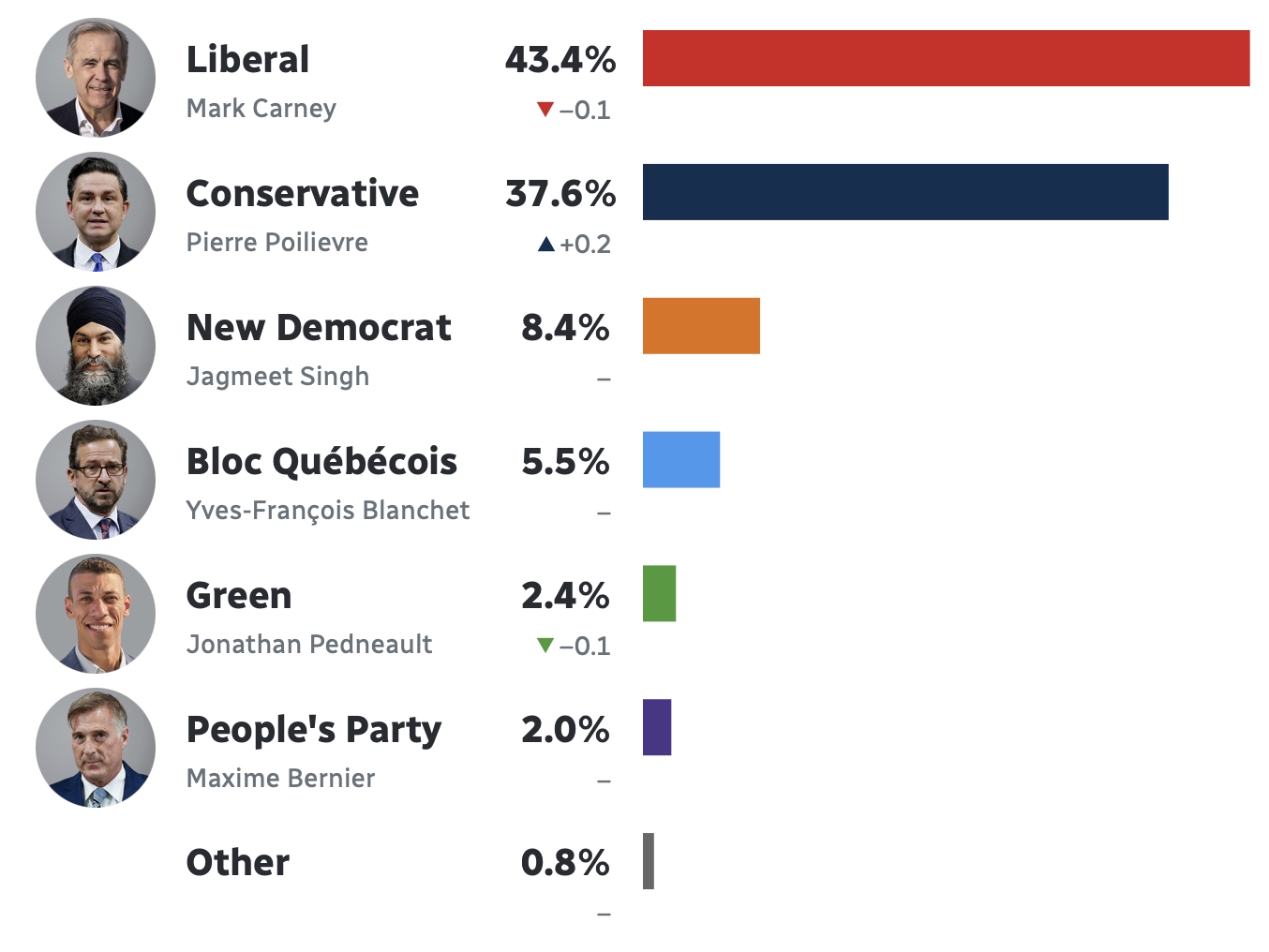

Éric Grenier, the brains behind the CBC’s Poll Tracker, says the Liberals remain on track for a majority win.

In his latest post this morning – the day after Trump announced his global tariffs – Grenier says:

“The Liberals are leading the Conservatives by roughly six points nationwide and would be heavily favoured to win a majority government if an election were held today. The New Democrats and Bloc Québécois, struggling to make headway in the polls, are on track to suffer significant seat losses.”

Leaning towards Liberals

For the past three days Grenier's model has moved Newmarket-Aurora from being a toss-up between the Liberals and the Conservatives to leaning towards the Liberals with a Conservative win still a possibility.

He defines “leaning” this way:

"The party is projected to be leaning and has a good chance of winning the seat, with odds ranging from roughly 68% to 95%."

Philippe Fournier of 338Canada.ca says the Liberals have climbed to their highest projection since the height of the pandemic.

“This second week of the federal campaign shows – on average – no tightening of the race, but rather a widening of the gap between the main parties…”

Collapse

The ascendancy of the Liberals has been fuelled by the collapse in the projected NDP vote.

Here in Newmarket-Aurora we have a completely invisible NDP candidate, Anna Gollen, who was selected, acclaimed and imposed by the Party High Command. The local Party is moribund.

Her name does not yet appear on the list of approved NDP candidates (as of 3 April 2025).

Missing candidates

Indeed the list only shows 205 candidates running for a Parliament with 343 seats (up from 338). This means that only 60% of ridings currently have an NDP candidate. Nominations close on 7 April 2025 and to get on the ballot paper a candidate must receive the endorsement of 100 electors. No mean task for a complete unknown.

The federal Conservatives and their cousins, the provincial progressive conservatives, have historically benefitted from a split in the vote on the centre-left.

It would be a tragedy if this happened yet again in Newmarket-Aurora where the insertion into the election of a completely unknown NDP appointee were to tip the balance and deliver the seat to the Conservatives.

Tariff Election

Trump’s tariff war has produced a major (if temporary) realignment in Party loyalties.

And Mark Carney is seen as being the man of the moment.

In the right place at the right time.

People are pragmatically choosing the Liberals as the best available bulwark against the utter madness of Donald Trump.

This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Gordon Prentice

![]()

A new face for the NDP

The NDP has just selected its candidate for Newmarket-Aurora, Anna Gollen.

She was acclaimed – as is the practice these days for so many candidates (regardless of Party) who are running for Parliament.

The idea of having local Party members choose between competing candidates - for the honour of being given the opportunity to represent the riding in the Ottawa Parliament - now seems a quaint relic of a bygone age.

Apparently, very few people are interested in a job with a base salary of around $210,000 a year. (Not that they are in it for the money. I say that seriously.)

Paper candidate

So far as I can tell Anna Gollen has no on-line presence and seems, on the face of it, to be a paper candidate. I don't recall our paths crossing. Anyway... I look forward to finding out more about her.

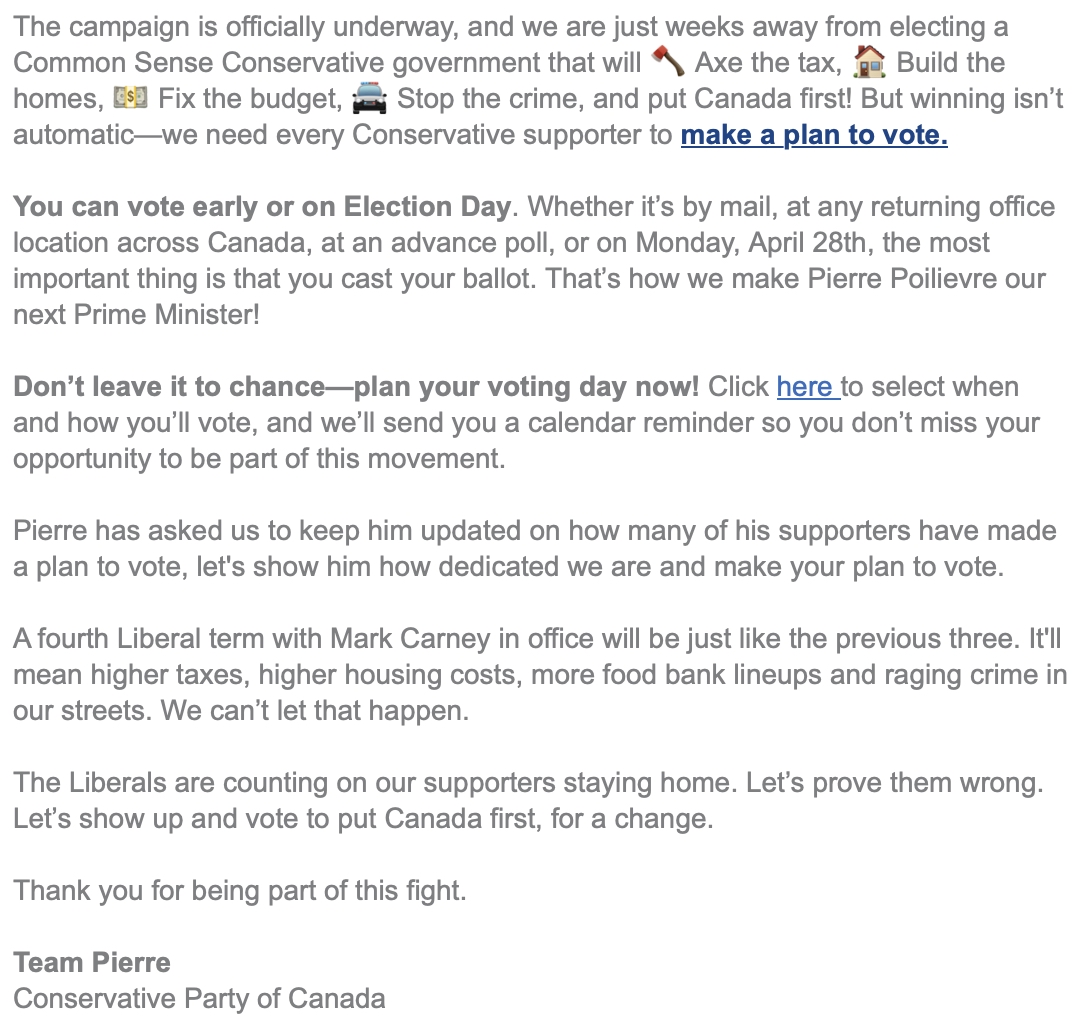

In the meantime, Newmarket-Aurora’s Conservatives are reminding their supporters to make a plan to vote. (See email below)

"Team Pierre"

Team Pierre’s email to local Conservatives rehashes all the old clichés (three words maximum): axe the tax, fix the budget, stop the crime and so on.

Talk about dumbing down. (Photo right: Sandra Cobena and Pierre Poilievre)

CBC Poll tracker

Elsewhere… the CBC’s poll tracker still puts the Liberals out in front but there’s many a slip twixt cup and lip and much can change in the course of an election campaign. But, for the moment, the Liberals are riding the crest of an amazing wave.

This morning, the CBC's Eric Grenier says the NDP

"appears to have hit their floor around 9% and the Conservatives have been holding steady with ticks up and down around the 37% to 38% mark over the last week. But it remains an open question what the ceiling is for the Liberals."

Cross-dressing

Of course, there is a lot of cross-dressing going on. And this can confuse the voters.

Political parties pretend to be something they are not in order to attract votes at the margin. It has always been this way. But technology takes it to a new level with Parties micro targeting voters, telling them what they want to hear.

It's the job of the media to dig deep and flag up the inconsistencies and contradictions.

The Trump tariffs this week will test all the parties. And the Liberals have their own problems with their candidate in Markham-Unionville. (Click "read more" below to read the piece in the Globe and Mail.)

This email address is being protected from spambots. You need JavaScript enabled to view it.

PS: I think it is still Pierre's policy to defund the CBC (three words).

But he seems to have gone quiet on that one recently.

Update on 1 April 2025: From the CBC: Liberal candidate withdraws from race

- Details

- Written by Gordon Prentice

At this early stage in the election campaign the result here in Newmarket-Aurora is too close to call.

The CBC’s Poll Tracker and expert number-cruncher, Éric Grenier, tells us the NDP is haemorrhaging support across the country and much of it is going to the newly ascendant Liberals.

We don’t know yet who will be running for the NDP. Nominations close on 7 April and there will be a complete list of candidates posted on the Elections Canada website on the 9th.

Advance voting begins in just over three weeks (on 18 April) so the Parties and the candidates have to hit the ground running.

Time to debate

On Monday I ran into the Liberal candidate, Jennifer McLachlan, whose team was putting the finishing touches to the Campaign HQ at Main and Botsford – a terrific location.

I asked her if she would be participating in any election debates and, without missing a beat, she told me she would be there. I was left wondering if her Conservative opponent, Sandra Cobena, would be quite so forthright or would she duck out of any invitation like so many of her Conservative predecessors. I hope she'd turn up. But the omens are not good.

Dawn Gallagher Murphy, the PC’s newly re-elected MPP, always boycotts debates. ‘Family emergency” was an early favourite but then she dropped all pretence and didn’t bother with excuses.

In the 2021 Federal Election here in Newmarket-Aurora, Conservative candidate, Harold Kim, boycotted the debates, citing diary clashes. And in the 2019 Federal Election Lois Brown was a no-show at the debate.

Consequential

But this election is different. It is truly consequential. We face an erratic and unhinged Donald Trump who talks enthusiastically about Canada becoming the 51st state. He mocked Trudeau as Governor of the “Great State of Canada” and ignorantly boasts there is nothing we produce that the United States needs.

So this is not another “business as usual” election. Far from it.

It is, therefore, a tragedy that the Chamber of Commerce will not be organising a candidates’ debate. Their Chief Executive, Chris Emanuel, told me on Monday they would not be taking the lead on organising a debate:

“We have expressed our willingness to partner with orgs (like the media) but we don't have the capacity to run all of the logistics like we once did.”

Full of hope, I contacted Newmarket Today who told me:

“We will not be organizing an election debate, it's not something we have the resources for at the moment.”

So it looks as if it will be left to citizens’ groups to organise something but if it is not “official” experience tells us some candidates may not show up.

Optional add-on

Debates are not an optional add-on to a properly functioning democracy. They are absolutely central.

When there are big policy differences between politicians a debate will elucidate. I recall Newmarket Mayor John Taylor demanding a debate in 2022 with Ford’s then Housing Minister, Steve Clark, who later presided over the Greenbelt scandal (and claimed ignorance of what was going on under his nose).

But here we are, at a crisis moment, and, shockingly, we have no debate to test the candidates. Voters need to see for themselves how the candidates measure up. Are they quick on their feet? How good is their grasp of policy? Can they persuade voters to support their platform? How would they deal with Trump?

Disturbing Trend

Two years ago, I wrote about the disturbing trend where candidates boycott debates when they see no advantage in attending. Back then I floated the idea of giving municipalities powers (if they don’t already have them) to organise election debates through an arms-length, independent agency if no other respected and independent third party was prepared to do so. If municipalities can appoint wholly independent people as Integrity Commissioners then why not let them appoint Debates Commissioners?

Of course, candidates could still choose to ignore an officially organised debate but I think the voters would notice.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Update on 29 March 2025: The Newmarket Era has confirmed it will not be organizing an election debate citing lack of resources.

![]()

Page 9 of 287